Canada is one of the most developed countries on the globe. Its facilities are top-of-the-line, and education is of the highest quality. One of the main factors contributing to its expansion is the real estate market. A variety of mortgages are offered to nationals and NRIs to reach new heights in the real estate market. One of the most well-known mortgages in the nation is the vacant land mortgage.

Through the help of financial institutions, the Canadian government offers benefits on these land mortgage loans. Anyone is entitled to apply for a vacant land mortgage after they meet certain criteria that, in turn, boost real estate in the country.

Let’s go through the several components of mortgages, particularly those for vacant land mortgages. Let’s discuss the interest rates that might apply, the banking institutions’ list, the eligibility criteria, the qualifying procedures for a land mortgage loan, and the Canadian government’s tax advantages.

Can One Get a Vacant Land Mortgage in Canada?

Vacant land mortgages are easy to get in Canada. Several banks, financial institutions, and private lenders offer land mortgage loans. Applying for a land mortgage in Canada needs a little documentation, and you must meet a few eligibility criteria. One can also get a competitive interest rate with the fast processing of an application after fulfilling all the requirements. Multiple factors and conditions affect whether you qualify for a closed vacant land mortgage in Canada or not.

Vacant Land Mortgage by Top Canadian Banks and Lenders

There are several banks and lending institutions/individuals in Canada that offer vacant land mortgages. A few of these banks, schemes, and lenders in Canada are listed below.

-

- Scotia International Bank

- Wayne Bank

- BMO Farm Mortgage

- People’s Security Bank and Trust

- Landmark Credit Union

- First National Mortgage Lender

- City Can Financial

- CIBC Farm Mortgage Loan

- TD Long Term Farm Loan

- RBC RoyFarm Agriculture Mortgage

Different Kinds of Real Estate Financing in Canada

Canada is a country where real estate is an essential factor in its development. To promote ownership of the real estate in Canada, a wide range of mortgages and loans are offered to citizens and even NRIs. Below are a few kinds of real estate financing in Canada available for all.

-

Land Mortgage Loan

Land Mortgage Loan is mentioned as the first real estate financing in Canada because it is what the blog focuses on. It is one of the financings which is similar to that of residential financing. However, it is not precisely what residential funding provides. Buying vacant land with the right financing becomes easier with land mortgage loan interest rates and down payments on vacant land mortgages as protection to recover the amount. The price of the built-up home on the land may have a high value for a shortfall by the lender if the mortgage defaults. But in the case of vacant land, it becomes tough for the lender to sell as it has no developed construction in the event of defaults by the payer. The vacant land mortgage makes it challenging for the lender to sell the property as it can have many shortcomings, like remote location, undeveloped locality, and no facilities apart from undeveloped construction on the land.

-

Construction Mortgages

One can avail of the construction land mortgage loan to construct infrastructure on the land aimed for purchase. With this mortgage, you can get financing both for buying vacant land and for the construction of the framework too. In Canada, construction mortgages take multiple rounds to sanction the amount for zero to the final construction process. Among all the rounds/draws, the first is to sanction the money for purchasing the land. The benefit of construction mortgages is that you are liable to pay the land mortgage rates only for the amount borrowed. Once the framework’s construction is completed, the financial institution asks to pay the interest rate as a standard mortgage. The institution also asks for a higher amount as a down payment for this mortgage. If you plan on buying vacant land and constructing infrastructure, construction mortgages can be your saviour, as you do not need to take out two mortgages simultaneously.

-

Agricultural Mortgages

Agricultural mortgages are the loans one takes out to purchase land for farming purposes. Under the Canadian Agricultural Loans Act (CALA) scheme by the Canadian government, financial institutions provide this mortgage. With the help of the act and the loan, the government aims to assist the growth of farming in the country. Under this programme, the government backs up lenders who provide loans and covers up to 95% of losses in cases of defaults. Since agricultural mortgages are highly secured, the institutions may only ask for a 10% down payment. The rest of the funds can be useful in ploughing and buying the right pieces of equipment.

-

Commercial Mortgages

Going for a land mortgage does not always mean that a person is considering building a home on it. Sometimes, this mortgage can also be for starting their firm. Many big corporations in Canada prefer to buy land to develop their office building on that parcel of land. There it is, the vacant land mortgage in the picture. This mortgage helps the companies to buy the parcel of land and get the infrastructure built there. Businesses are required to present a coherent business plan to the lending institution in order to avail of this loan.

Other Kinds of Home Financing

Several financing options are available for real estate in Canada. These include the choices for vacant land mortgages as well.

-

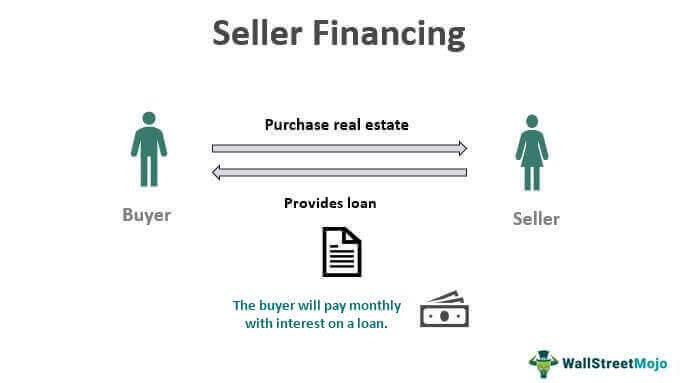

Seller Financing

Seller financing is another funding option only if the seller of the property offers it. Herein, the seller plays the role of a lender and requires the down payment amount with regular payments paid in land mortgage loans. Until the mortgage is paid in full, the borrower is liable to use the property but does not get the ownership of the title deed. This form of financing is advantageous for you as you are no longer required to go through the hectic rules and steps of availing of a mortgage from the bank. Also, if the banking institution rejects your application, then the seller’s financing can come into play and help you accumulate funds for the property.

In order to buy an expensive real estate property, the traditional mortgage and seller financing combination will help. The home loan and land mortgage rates can be discussed and negotiated with the lender (seller).

-

Home Equity Loan

A home equity loan can be helpful if you are the owner of a home and want to purchase the land. If you wish to move from the bustling city to the countryside, the existing home can be used as equity to purchase the new property or as a vacant land mortgage.

The Home Equity Line of Credit, also known as HELOC, will let you borrow funds while keeping the home as equity. This kind of financing is easy to avail for people as they already have home equity to avail the loan amount and invest in vacant land.

-

Personal Loans and Private Financing

Banking and financial institutions are the most famous and reliable means of financing in Canada. At the same time, personal loans and vacant land mortgages are also preferable choices for borrowers. Lending money from private lenders in the form of personal loans can be used for buying vacant land in the country.

The private lending and funds providers sometimes lend the amount that the big financial institutions refuse to do. In the case of a poor CIBIL score, private lenders can lend you funds for purchasing the land. Additionally, there are no specific criteria that the private lender and the borrower have to follow, making getting a mortgage easier. A drawback of this financial solution is the short period offered by the lenders and the high-interest rates with minimum requirements.

Vacant Land Mortgage Rates in Canada

The mortgage rates on vacant land in Canada vary from one financial institution to another. The approximate land mortgage rates for land are mentioned in the table below.

|

Vacant Plot Type |

Land Mortgage Rates of Interest |

Interest Rates (relative to Prime Rate of the Bank) |

| Serviced city lot, residential zoning | 20 to 30% | Prime +1% to Prime +4% |

| Serviced rural lot, residential zoning | 30 to 40% | Prime +2% to Prime +4% |

| Partially-serviced rural lot, residential zoning | 35 to 50% | Prime +2% to Prime +4% |

| Raw land, some services, the plot for agricultural zoning | 35 to 50% | Prime +2% to Prime +7% |

| Raw land, no services, plot for agricultural zoning | 35 to 50% | Prime +2% to Prime +7% |

| Farming | 20 to 25% | Contact Farm Credit Canada |

What are the Must-Haves for Getting a Mortgage on Land?

In order to get approval and a method for applying for a land mortgage in Canada, one needs to fulfil a specific set of requirements laid out by the financial institution. The must-haves for getting a mortgage on land in the country are as follows:

- Good Credit History : In order to get a vacant land mortgage in Canada, you must maintain a good credit/CIBIL score. It is because a person with a good credit history gets a low rate of interest applied to the mortgage. The chances of getting a mortgage and acceptance of the application increase. It builds confidence that the borrower is trustworthy and can pay the money back on time.

- Income Proof : All financial institutions in Canada will ask for income sources and proof from the borrower. Be it self-employed or a salaried individual, everyone is required to submit this proof. Submission of these documents helps the institution to analyse the payback capability of the borrower.

- Business/Land Plan Strategy : If you are planning to purchase vacant land for the purpose of setting up a business, submitting a well-planned blueprint helps the borrower get low-interest rates applied to their mortgage.

How to Apply for a Land Mortgage in Canada

If you are reliable on vacant land mortgages, then the acceptance of the loan application is the most important step in the process. This pre-approval of the mortgage application can turn out to be beneficial for you as a buyer. When applying for a vacant land mortgage in Canada, the lender will access all your needs before accepting or rejecting the application. As a result, if approved, it becomes easy for you to deal with all the land buying steps.

Specific land mortgage rates, down payment, and other details are asked by the lender if the land mortgage is pre-approved. However, if not, you will be required to follow a specific mechanism to get a vacant land mortgage in Canada. The pre-approval methods and post-approval methods have the same criteria and ways. The bank or financial institution asks for the details of the land, income proof, and other details like identity proof, age proof, etc., along with the duly filled application form.

In addition to that, the lender will also ask for details that prove the down payment is not a borrowed amount. Each financial institution has its own specific set of requirements, making applying for a land mortgage a researched task before setting for one.

After the mortgage broker has accumulated all the information and documentation, they will send it to the underwriter of their financial institution for further processing. To approve the application, a Canadian financial institution uses the debt service ratio method. If the application fits into their guidelines, it is approved or else rejected. Yet, the land mortgage loan and its requirements play a crucial role in application acceptance.

You May Also Read

| Real Estate Mortgage Process | Reverse Mortgage loan |

| Reverse Mortgage Scam | Mortgage Stress Test in Canada |

| Reverse Mortgage in Canada | Credit Score for a Mortgage |

Frequently Asked Question (FAQs)

Yes, it is possible to get a mortgage loan on land in Canada. However, the interest rates and down payments are usually higher for such mortgages as they carry high risks.

The value of the parcel of land can be used for some part or whole of the down payment in Canada.

Most top-tier banks are good for availing vacant land mortgages in Canada. A few of these banks are COBC, RBC, etc.

In Canada, the tax benefits on land mortgage loans are applicable as per their income tax rules and regulations. But it is applicable only after construction begins on that parcel of land. Can we get a mortgage loan on land?

Can you use land as a down payment in Canada?

Which bank is best for a land loan in Canada?

Do land loans have tax benefits?